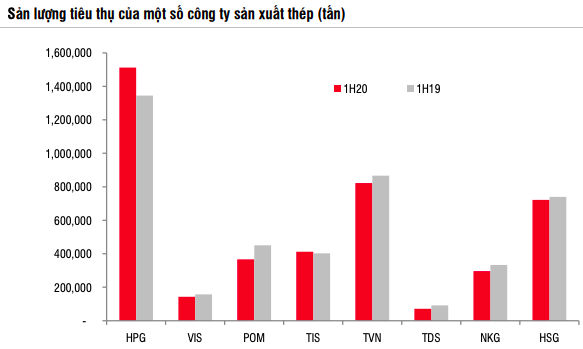

In which, according to SSI Research's point of view, steel industry will change the industry structure after Covid-19, consolidation may accelerate in favor of market leaders. In addition, firms tend to more diversify their export market bases to reduce their dependence on any one market.

SSI Research has just reported the steel and cement industry. In which, according to SSI Research's point of view, steel industry will change the industry structure after Covid-19, consolidation may accelerate in favor of market leaders. In addition, firms tend to more diversify their export market bases to reduce their dependence on any one market.

Steel industry: Narrow down trend in Q2 / 2020 shows signs of recovery

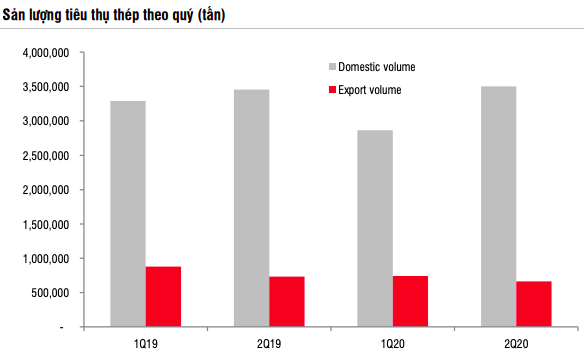

Noted, steel consumption recovered positively in Q2 / 2020, due to demand from the civil segment. In which, consumption for finished steel products decreased by 7% over the same period in the first 6 months of 2020, of which domestic consumption decreased by 6%. Export volume fell sharply at -13% YoY due to social gap policy in export markets.

However, compared with a 14% y-o-y decrease in Q1 / 2020, a 1% y-o-y decline in Q2 / 2020 can be considered a sign of recovery. Domestic demand was even up 1% from a 13% decline in the first quarter of the year. SSI Research believes that this is due to pent-up demand from Q1 as well as stable revenue consumption in the civil construction channel.

The outlook for the second half of 2020 is estimated that demand in the second half of the year will recover and increase 4-5% year-on-year due to the loosened social gap policy and increased public investment (estimated at 15% of steel consumption).

In addition, SSI Research believes that Vietnam benefits from continued strong steel demand in China. According to the China Iron and Steel Ore Association, China's steel consumption is estimated to increase 40 million tons, equivalent to an increase of about 8% year-on-year in the second half of 2020, and 2% for the whole 2020. In the second half In early 2020, Vietnam's steel output exported to China has increased significantly, nearly 15 times, to 1.06 million tons, about 27% of Vietnam's total steel export output.

By 2021, demand is estimated to increase by around 3-5% from a low base level in 2020, thanks to overall macroeconomic expectations recovering, along with investment in infrastructure and FDI in Vietnam.

According to the World Steel Association, global steel demand is expected to recover 4% in 2021, which will support the export channel of Vietnamese manufacturing companies.

Cement industry: No major structural changes after the epidemic, demand in the second half of the year will increase thanks to public investment

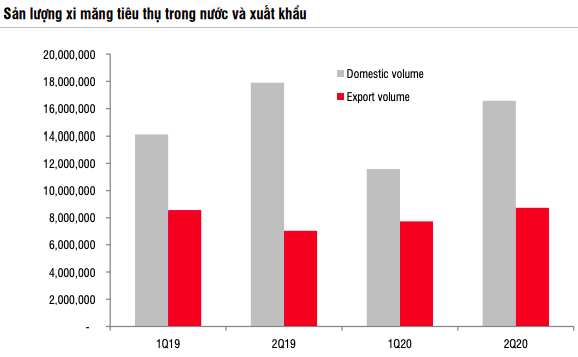

Regarding the cement industry, on the contrary, there will be no changes in market structure especially after Covid-19. It is known that domestic cement consumption decreased by 12% year-on-year in the first 6 months of 2020 due to slowing construction activities. However, demand recovered in Q2 when the Covid-19 translation was under control. Domestic production decreased at a lower rate of -7% y-o-y in Q2 / 2020, better than the 18% decline in Q1 / 2020.

Export volume maintained growth thanks to Chinese demand: Export channel recovered stronger, with volume increasing 24% year-on-year in Q2 / 2020 after decreasing 10% year-on-year. in the first quarter of 2020. This has been driven by China's need to build infrastructure. Therefore, the total export volume in the first 6 months of 2020 increased by 6% over the same period, of which the export volume to China increased 35% over the same period, and accounted for 52% of the total export volume.

Prospects for the second half of 2020, SSI Research estimates that domestic demand in the second half of 2020 will recover by 3% YoY, thanks to boosting public investment. Notably, HT1, the leading cement company in the country, achieved a 6% growth in profit from operating activities in the first 6 months of the year. SSI Research continues to believe that improvements in gross margins in this industry will continue, benefiting from lower coal input prices, as well as positive cuts.

In 2021 SSI Research thinks that demand may recover 3-5% from the low in 2020 due to the recovery of the macro economy, and infrastructure construction activities.

Articles CafeF